Taskforce on Nature-related Disclosures (TNFD)

What is the TNFD?

The Taskforce on Nature-related Financial Disclosures (TNFD) is a market-led initiative launched in 2021. The initiative builds on the related Taskforce on Climate-related Financial Disclosures (TCFD), but with a focus on nature and biodiversity. The TNFD provides a risk management and disclosure framework for corporate and financial organisations to report and act on their nature-related risks. Overall, it aims to support a shift in global financial flows away from outcomes that harm nature, and towards nature positive outcomes.

The Taskforce on Nature-related Financial Disclosures (TNFD) is a market-led initiative launched in 2021.

How TNFD works: the LEAP approach

TNFD recommends the use of its Locate, Evaluate, Assess and Prepare (LEAP) methodology for reporting and disclosing nature-related risks:

-

Locate your interface with nature;

-

Evaluate your dependencies and impacts on nature;

-

Assess your risks and opportunities; and

-

Prepare to respond to nature-related risks and opportunities, and report

More than 240 organisations have pilot-tested versions of the LEAP approach. While corporates in different sectors will face different challenges in following the LEAP process, they will find it useful for identifying and assessing their nature-related issues, especially if they have only just begun their nature positive journey.

How we can help you align with TNFD

Our experts at The Biodiversity Consultancy have a wealth of experience with the TNFD framework, and are able to support you through:

-

Gap analysis and internal readiness planning

-

Holistic alignment of your TNFD disclosures with those of other reporting standards (like GRI, ESRS/CSRD, ISSB, SBTN, and CDP)

-

TNFD-aligned target-setting workshops and nature-strategy development

-

Application of science-based dependency, impact, risk and opportunity analyses aligned with the LEAP approach

-

Disclosure and reporting in alignment with TNFD’s recommendations

How we can help you integrate TNFD into your business

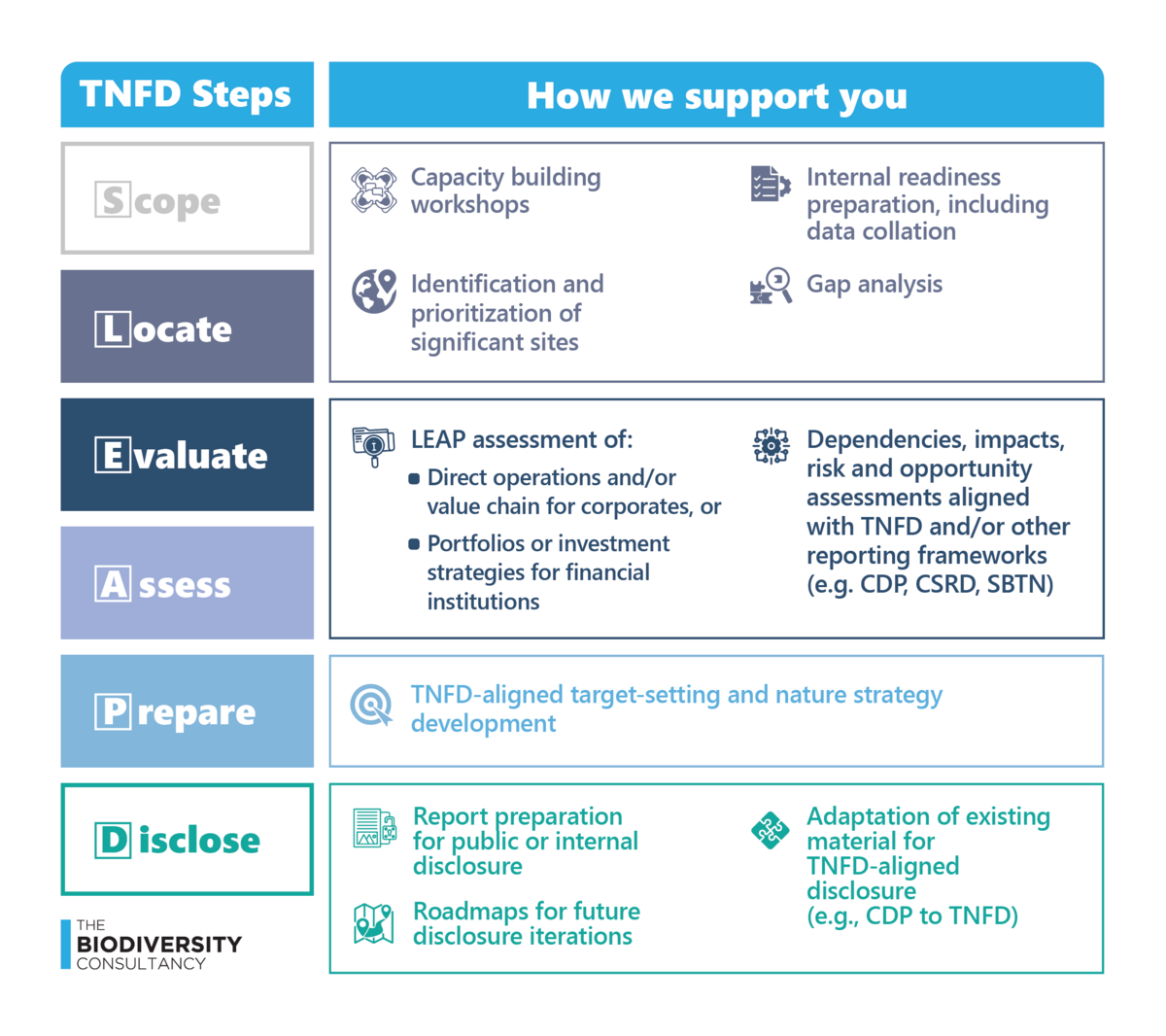

Our specialist sector teams can also guide you through any part of the LEAP process, including the Scope and Disclose phases, as illustrated below:

How we contribute to TNFD development

Our consultants have directly contributed their science expertise to the development of the TNFD framework. For example:

-

We contributed to TNFD’s framework development (v0.3, v0.4, and v1.0 releases)

-

We led the development of biome-specific guidance for tropical forests, marine shelf, rivers and streams, intensive land-use, grasslands and savannas

-

We led the review of TNFD’s metrics for ecosystem condition

-

We were a technical reviewer of sector-specific guidance

-

We were a technical partner for TNFD’s metrics and targets workstream

-

We were a member of TNFD Data Catalyst, which brought together a range of actors to identify shortcomings in nature-related data, and recommend ways to accelerate the development of nature-related analytics and tools

-

We facilitated the official piloting of the TNFD framework with Global Canopy.