Using TNFD’s LEAP approach to integrate nature into Finnish financial development with Sitra

Sitra is Finland’s Innovation Fund. Its mission is to promote the well-being of Finland while accelerating economic growth in a way that respects nature's limits.

The Biodiversity Consultancy supported Sitra with their mission by designing and delivering a series of workshops for Finnish financial institutions about how to begin to integrate nature into their operations and financing decisions, thereby empowering those institutions to support economic growth in harmony with nature.

Following the success of this project, which was also supported by Luontoa in Finland, The Taskforce on Nature-related Financial Disclosures (TNFD) has now launched The Biodiversity Consultancy and Sitra’s set of training materials designed to help financial institutions apply TNFD’s LEAP approach in practice. Find out more here.

How The Biodiversity Consultancy helped Sitra realise their vision: using the TNFD-LEAP to connect the natural and financial worlds

Ninety-eight percent of asset managers and owners are concerned about the impact of nature loss on financial markets. The collaboration with Sitra utilised TNFD’s LEAP approach to make this connection between nature and finance: creating a series of workshops for Finnish financial institutions and a final guidance document that walked through the tools, methods and evidence to assess how nature loss is material to financial institutions.

Challenge: assessing nature-related dependencies, impacts, risks and opportunities (DIRO) in a resource-efficient and decision-useful way

Two core challenges inhibit the assessment of nature-related DIRO that financial institutions are exposed to via their lending, investments and other activities:

-

The scale and diversity of portfolios—spanning multiple sectors and geographies—make comprehensive risk assessment complex.

-

The lack of location and operational data about portfolio companies and clients (including their upstream suppliers) creates large uncertainty.

This can make assessment of DIRO either extremely resource-intensive or its conclusions not robust enough to confidently take action, e.g. set targets, alter financial terms etc.

In response, we designed for Sitra a highly pragmatic ‘how to’ approach to assessing nature-related DIRO, sensitive to the data and resource-constrained context but that still produces decision useful results.

Approach: ‘multiple passes of LEAP’ so the level of analysis matches the significance of the nature-related DIRO

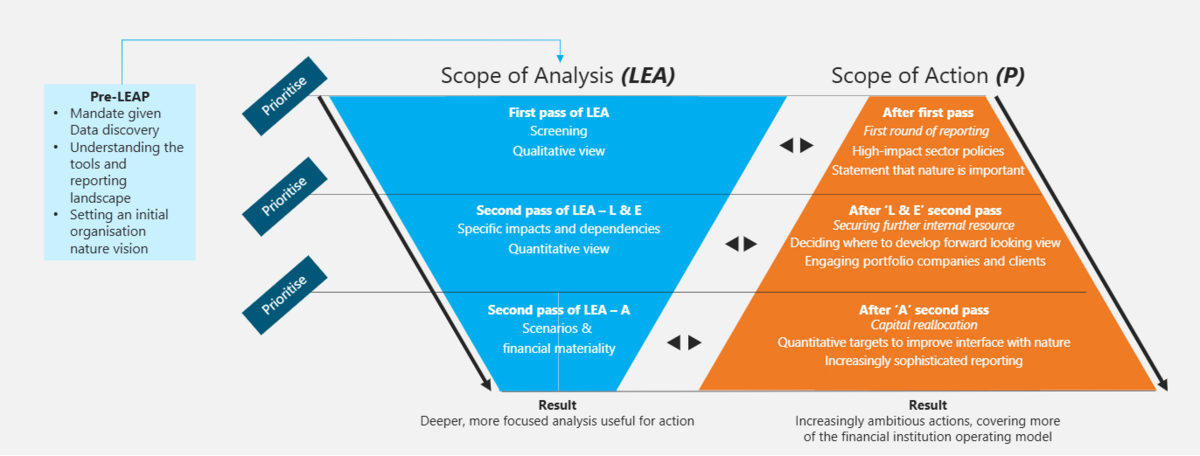

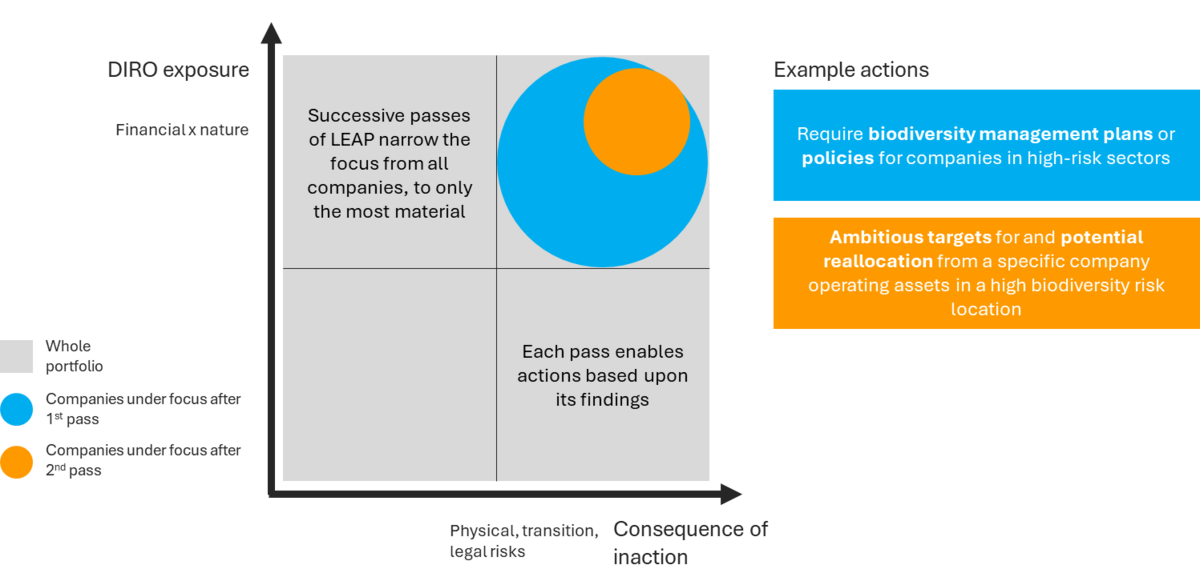

We developed a novel approach to applying LEAP – involving “multiple passes of LEAP”. Each pass covers a different scope of analysis – portfolio, specific geography, specific asset, specific nature risk etc. – so that effort is focussed on assessing the most significant DIRO to the extent that appropriate tools and data are available.

As the below diagram shows, each scope of analysis leads to an action for the financial institutions. As the scope of analysis becomes narrower, its deeper conclusions are also likely to support more consequential action. For example, assessing risk and opportunities during the second pass of LEAP requires location-specific information about how companies depend and impact nature and scenarios about how the state of nature is degrading. Conclusions from such detailed assessments give an indication of financial materiality, which can justify capital reallocation if the companies are found not to be taking appropriate steps to respond.

-

First pass: screening requiring no location or company operation information

This step involves evaluating potential impacts and dependencies within different sectors using tools based on global averages (locate and evaluate of LEAP). This enables a qualitative assessment of the sectors with the highest potential for nature-related physical and transition risks (asses of LEAP). This allows financial institutions to prioritise these exposures for engagement for gathering more detailed data or for policies or mitigation actions (prepare stage of LEAP).

For example, this analysis could show that a material amount of impacts in the portfolio are associated with companies purchasing palm oil, offering a bank an audit trail and justification to prioritise supporting clients to manage deforestation risk in their portfolios.

-

Second pass, step 1: Location-specific evaluation

Knowing what sectors, portfolio companies and clients are most important to prioritise for further analysis, the second pass gathers asset-location, operational or sourcing data from those companies. Layering this with nature-data layers, e.g. ecosystem intactness, enables a quantitative view on where and how much impact or dependence companies have on nature. This covers both the locate and evaluate stages of LEAP, but in a quantitative way.

This evaluation could show that a company with high water usage is operating in a highly water stressed area. An investor could then have the data and justification to engage specifically on the water stewardship plans of the company.

-

Second pass, step 2: Risk scenario application

In the final step, physical or transition risk scenarios are applied to the highest-impact or dependency locations or companies to assess the financial risks and opportunities. This assessment can support risk management processes and justify capital reallocation or stricter lending criteria. It covers the assess stage of LEAP in a quantitative way.

An example outcome of this pass could show that agriculture clients of a bank are in areas with declining soil quality and quantify the financial risk of this to future company cash flows, impacting the risk rating for that client.

Each ‘pass’ of LEAP increases the confidence about what DIRO the portfolio company or client is exposed to. As such, the passes narrow focus and justify action, as shown below.

In-person workshops empowered financiers to begin integrating nature into their strategy and decisions

How to apply the above LEAP approach was detailed in a series of four highly interactive day-long workshops with banks and investors at Sitra HQ in Finland. The workshops used hands-on exercises, group discussions, and real-world examples to ensure relevance and provide immediate, practical value – utilising tools like the WWF Risk Filter suite. Examples and exercises were tailored to the participants’ knowledge and expertise – covering portfolio heatmapping, location-based nature assessment and scenario analysis. They focused on material Finnish examples, such as the damage that increasing frequency and intensity of bark beetle infestations can cause to the logging industry, a key industry in the country.

Outcome – enabling financial institutions to better understand their nature-related DIRO, justifying more ambitious action on nature

By following the steps detailed in the guidance published following the workshops, financial institutions can avoid resource-intensive nature-related analysis, ensuring effective risk triage that better informs their decisions and ambitions on nature.

As well as detailing practically ‘how to’ assess the interface between finance and nature, the guidance matches the level of confidence about the exposure to nature-related DIRO with an appropriate action. To this end, an action plan template was created for financial institutions that participated in the workshops held at Sitra HQ that covered, for example, how the first pass of LEAP is useful for engagement and risk triage.

The ‘how to’ focus of the workshops and subsequent guidance published has been extremely well received and has led to:

-

TNFD publication: TNFD has published an abridged version of the training alongside the action plan template, see here.

-

Immediate action: Institutions begun assessing nature-related risks right away, without needing to invest in costly, long-term programs.

-

Progressive refinement: Initial assessments allowed institutions to prioritise further investigation and integrate findings into their risk management frameworks.